In today's monetary landscape, many individuals find themselves in need of fast cash but wrestle with poor credit score rankings. For these in the UK, unsecured loans for bad credit can provide a viable resolution to satisfy urgent monetary wants. This text goals to discover what unsecured loans are, how they work, the choices accessible, and the considerations to remember when applying for one.

What are Unsecured Loans?

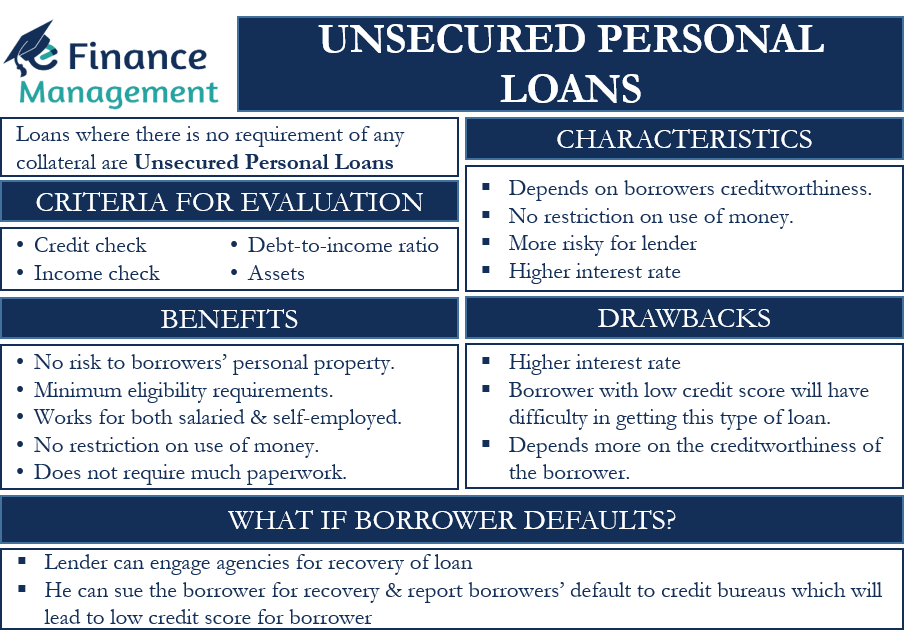

Unsecured loans are a kind of borrowing that does not require the borrower to supply collateral. Which means the lender can't seize assets, resembling a home or car, if the borrower fails to repay the loan. As an alternative, the lender assesses the borrower's creditworthiness primarily primarily based on their credit score historical past, income, and other monetary components. As a result of unsecured loans carry a higher risk for lenders, they usually come with larger curiosity rates compared to secured loans.

Understanding Dangerous Credit

In the UK, a bad credit score ranking can arise from varied causes, including missed payments, defaults, or a lack of credit score historical past. Credit score scores vary from 0 to 999, with scores below 560 typically thought of poor. People with unhealthy credit may find it challenging to secure loans from traditional lenders, comparable to banks and building societies. Nonetheless, various lending options have emerged to cater to this demographic.

Unsecured Loans for Bad Credit: How They Work

When making use of for an unsecured loan with dangerous credit, the lender will evaluate the borrower's financial situation to find out eligibility. This analysis might involve checking the borrower's credit score score, earnings, employment standing, and current debts. The quantity that can be borrowed and the interest charges will depend upon these factors.

- Loan Quantities: Unsecured loans for bad credit sometimes range from £1,000 to £25,000, although some lenders could provide higher quantities. The particular quantity obtainable will rely on the borrower's monetary profile.

- Repayment Terms: Most unsecured loans include repayment phrases ranging from one to seven years. Borrowers ought to consider their skill to repay the loan within the desired timeframe to avoid additional financial strain.

- Interest Rates: Curiosity rates for unsecured loans can range considerably primarily based on the lender and the borrower's creditworthiness. Individuals with poor credit score could face increased charges, which could make repayment more challenging.

Varieties of Unsecured Loans for Bad Credit

Several kinds of unsecured loans can be found for people with dangerous credit within the UK:

- quicken personal loans for bad credit Loans: Personal loans are the commonest sort of unsecured loan. They can be utilized for varied functions, including debt consolidation, house enhancements, or unexpected expenses. Borrowers can apply for personal loans for bad credit history loans from banks, credit unions, or on-line lenders.

- Payday Loans: Payday loans are short-term loans designed to cowl immediate bills till the borrower receives their next paycheck. While they're accessible to people with dangerous credit score, they often come with extremely excessive-interest charges and needs to be approached with caution.

- Guarantor Loans: Guarantor loans require a co-signer (the guarantor) who agrees to repay the loan if the borrower defaults. This arrangement can help individuals with bad credit safe better loan terms, because the lender has an added layer of safety.

- Peer-to-Peer Lending: Peer-to-peer lending platforms join borrowers with individual buyers who fund loans. These platforms typically have more versatile lending standards, making them a possible choice for these with dangerous credit.

Execs and Cons of Unsecured Loans for Bad Credit

Earlier than making use of for an unsecured loan, it is important to weigh the advantages and disadvantages:

Execs:

- No Collateral Required: Borrowers do not have to danger their property.

- Quick Access to Funds: Many lenders supply quick approvals and funding, making it an appropriate choice for urgent financial wants.

- Flexible Use: Borrowers can use the funds for various functions, depending on their wants.

Cons:

- Higher Curiosity Charges: Borrowers with unhealthy credit typically face greater curiosity charges, leading to elevated general repayment prices.

- Shorter Repayment Phrases: Many unsecured loans include shorter repayment durations, which may lead to larger monthly payments.

- Potential for Debt Cycle: If not managed correctly, unsecured loans can lead to a cycle of debt, particularly if borrowers take out a number of loans to cowl current debts.

Ideas for Securing an Unsecured Loan with Dangerous Credit score

- Verify Your Credit score Report: Before making use of for a loan, receive a replica of your credit score report to know your financial standing. Tackle any inaccuracies which will negatively impact your rating.

- Compare Lenders: Shop around and examine totally different lenders to search out one of the best curiosity rates and phrases. Use online comparability instruments to make this course of simpler.

- Consider a Guarantor: If potential, ask a trusted friend or family member to act as a guarantor. This could enhance your probabilities of approval and should lead to better loan terms.

- Borrow Solely What You Need: Avoid borrowing more than you possibly can afford to repay. Create a price range to determine how much you can realistically handle.

- Read the Tremendous Print: At all times read the phrases and circumstances of the loan agreement rigorously. Search for any hidden charges or costs that will apply.

Conclusion

Unsecured loans for bad credit could be a useful monetary tool for individuals facing unexpected expenses or seeking to consolidate debt. Should you have any concerns relating to in which and also the best way to employ personal loans for bad credit no credit check, you'll be able to email us at our own page. While they provide fast entry to funds without requiring collateral, it's essential to strategy them with warning as a result of potential for high-curiosity charges and the risk of falling into a cycle of debt. By understanding the choices accessible and making informed selections, borrowers can navigate the lending panorama successfully and improve their monetary effectively-being.